Intro: The Ocean of Opportunity

Every captain dreams of a successful voyage—but not all who set sail return with gold. Investing is your long-term journey toward financial growth, and like any open-sea expedition, it demands preparation, patience, and clear thinking. There’s no shortage of shiny objects and shortcuts, but the true art of investing lies in mastering a few timeless principles.

These aren’t fads or secret maps—they’re well-tested rules that protect your ship from storms and help you ride favourable winds. Whether you’re investing through a Stocks & Shares ISA, workplace pension, or a personal brokerage account, these rules apply across the board.

Let’s chart the course.

Rule 1: Don’t Put All Your Gold in One Chest

Diversification is your lifeboat. Spreading your investments across different asset types—like shares, bonds, and property—helps manage risk.

In practical terms, that might mean:

- Using a low-cost global index fund instead of picking a few UK stocks

- Balancing riskier assets (like emerging markets) with more stable ones (like bonds)

A well-diversified portfolio keeps your journey balanced even when one route gets choppy.

Rule 2: Stay on Course

Markets rise and fall. Storms will come. But jumping ship when waters get rough often leads to loss. The most successful investors ride out volatility and avoid panic-selling.

Stick to your strategy. Tune out the noise. Revisit your goals instead of reacting to headlines.

Rule 3: Start Early — Let Time Be Your Tides

Time is the most powerful force in investing. Thanks to the magic of compound interest, even modest investments made early can grow into substantial sums.

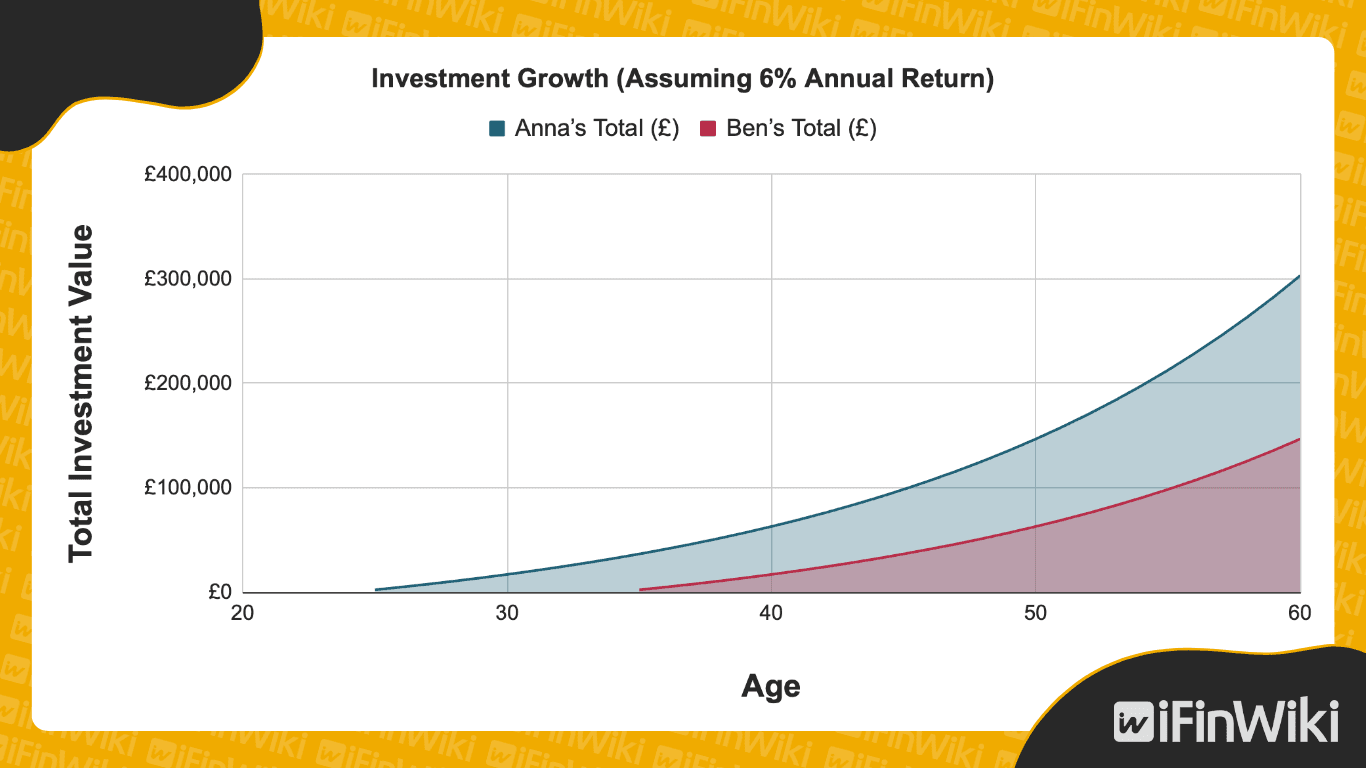

Picture two captains:

- Captain Anna starts investing £200/month at age 25.

- Captain Ben starts the same at age 35.

Assuming 6% return (per year), by age 60:

- Anna will have around £232,000

- Ben will have around £120,000

That 10-year head start gave Anna nearly double the treasure—even though they both invested the same amount each month (!)

Rule 4: Know What You Own

Blindly buying into something you don’t understand is like sailing without a compass. Whether it’s an ETF, individual stock, or crypto coin, take time to learn what drives its value.

Start simple. If you can’t explain it in a sentence, it might be worth skipping—or digging deeper.

Rule 5: Keep Costs Low

High fees are like leaks in your hull—they might seem small, but over time they can sink returns.

Use low-cost platforms and funds. Look for:

- Expense ratios under 0.5% for passive funds

- Platforms that don’t charge high account or transaction fees

Saving 1% in fees each year could leave you with thousands more in the long run.

Providers for UK Investors

Ready to apply these rules? Here are a few beginner-friendly options tailored to UK captains:

- Freetrade – beginner-friendly investing app with commission-free trades

- Trading212 – solid affordable all-rounder with wide fund and share access

- Vanguard UK – great for low-cost index funds and SIPPs

- InvestEngine – robo-advisor that can automate diversification and strategy

You don’t need to master everything at once—just find the right vessel for your journey.

Captain’s Checklist

✅ Set a clear investment goal (e.g. retirement, home deposit, long-term wealth)

✅ Start investing early, even with small amounts (e.g. £25/month)

✅ Review your investments annually but avoid constant tinkering

✅ Keep costs low—avoid high-fee platforms and actively managed funds

✅ Educate yourself on any investment before jumping aboard

Final Thoughts: A Steady Hand on the Wheel

Investing isn’t a race—it’s a voyage, and you are in charge. Start early if you can, but start where you are. Keep your course steady, minimise costs, and resist the urge to jump ship when markets wobble. These golden rules aren’t flashy—but they work.

It’s easy to be tempted by shortcuts or the noise of fast-moving trends. But true financial freedom isn’t built overnight. It’s earned over time, with consistent effort and a clear plan. Let your investments work for you in the background while you focus on living your life. Build a strong vessel, trust your compass, and adjust your sails only when needed.

Keep educating yourself. When you need to pause, refuel, or seek out fresh tools for the journey, think of iFinWiki as your home harbour—always open, safe, stocked with insights, and ready to help you navigate even smarter. The seas may shift—but with steady hands and the right map, you’ll arrive where you set out to go.

P.S. Explore our Tools section: your one-stop spot for practical tools, new offers, and ways to make your money go even further.

Note: All investments carry some degree of risk, so it’s important to understand how your money could be affected. Not all risks are equal—the potential for gains or losses can vary significantly from one investment to another. This article is for general information only and does not constitute financial advice. Always consider your personal circumstances before making any investment decisions.